Report on Jobs: Candidate shortages and economic uncertainty weigh on permanent placements in November

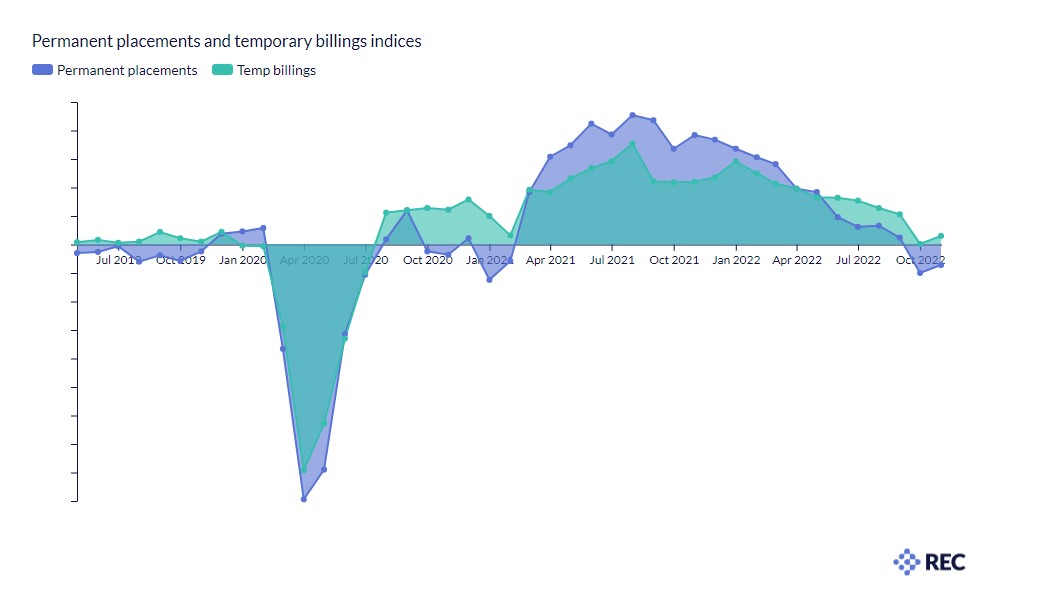

The latest KPMG and REC UK Report on Jobs survey, compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies, showed a notably permanent placements fell for the second consecutive month, and temp billings rose only modestly. Meanwhile, overall vacancies expanded at the softest pace for 21 months.

Permanent placements fall, temp billings expand modestly

Overall demand for workers expanded at the softest rate since February 2021 during November. While temporary vacancies continued to expand more sharply than that seen for permanent roles, in both cases the increases were the slowest seen for 21 months and below their respective long-run trends.

The overall availability of workers continued to deteriorate during November, and at a steeper pace than seen on average since the survey began 25 years ago. Tight labour market conditions, fewer foreign workers, and a greater hesitancy among people to take up new roles due to increased economic uncertainty all dampened candidate numbers, according to recruiters. However, the latest fall was the weakest recorded for just over a year-and-a-half amid softer declines in both permanent and temporary staff supply.

Claire Warnes, Partner, Skills, and Productivity at KPMG UK said: “Of particular note this month is the softer rise in permanent starters’ salaries, with the rate of pay inflation easing to a 19-month low in November. This reflects the combined effects of employers reining in recruitment, candidate availability continuing to decline, and workers staying put for job security. So, despite the cost-of-living pressures that households are enduring and the industrial relations impasse within many sectors, wage growth may well be trending down in the months ahead. Employers who are able to offer existing workers and candidates’ opportunities to upskill and reskill, rather than focusing solely on core pay, may well benefit most in this tight jobs market.”

Neil Carberry, Chief Executive of the REC, said: “This month’s data emphasises that while employers are moderately more cautious in the face of economic uncertainty, this is not yet a major slowdown in hiring. While permanent recruitment activity has dropped from the very high levels of earlier in the year, the pace of that drop has tempered this month. In contrast, temporary hiring has accelerated again in the run-up to Christmas. There are clearly some seasonal factors at work here, with retail and healthcare recruitment leading the way. But there may also be some switching to temporary going on, as firms maintain flexibility ahead of next year.

“As the economic outlook weakens, we can expect to see falls from historic highs across our measures, but it is notable that pay and vacancies are still growing, although at a much lower rate. A flatter period in the labour market is inevitable in this current economic climate, but demand is being supported by some major underlying factors, including labour shortages and technological change. The main way to boost performance is to unlock growth by businesses putting their people planning first, as a strategic way to enhance productivity. Government can help through skills and immigration reform. Boosting growth is the only way to ensure a prosperous country for all of us.”