2023: Permanent placements return to growth

2023 has started off on a positive note for permanent placements, with a return to growth being reported. In the first quarter of the year, the number of permanent placements rose by 1.2%, according to the latest survey from the Recruitment & Employment Confederation (REC).

The report also revealed that there has been an increased demand for staff across a range of sectors, including IT, hospitality and healthcare. This is great news for the UK job market, which has been impacted by Covid-19 over the past year.

The REC survey also showed that the demand for temporary staff has remained strong, with a 2.2% increase in the first quarter of the year. However, employers are showing a preference for permanent staff, which is a positive sign for the economy.

Rates of vacancy growth in the private sector continued to exceed those seen for the public sector at the start of 2023.The strongest upturn in demand was signalled for private sector permanent staff, while the softest was seen for permanent workers in the public sector.

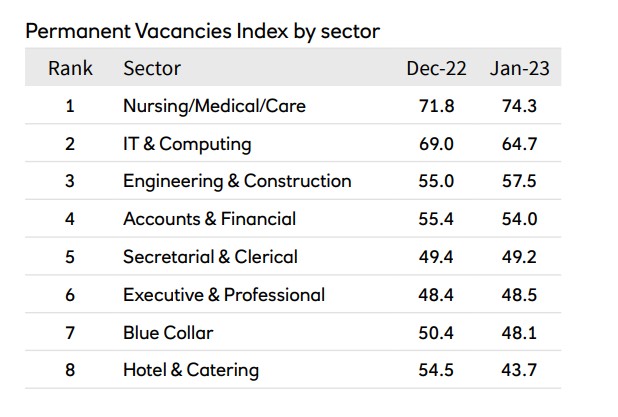

Nine of the ten monitored job categories registered an increase in permanent staff demand in January, with the exception of Retail. Of the sectors that saw an expansion in vacancies, Nursing/Medical/Care posted the strongest growth and Hotel & Catering the weakest.

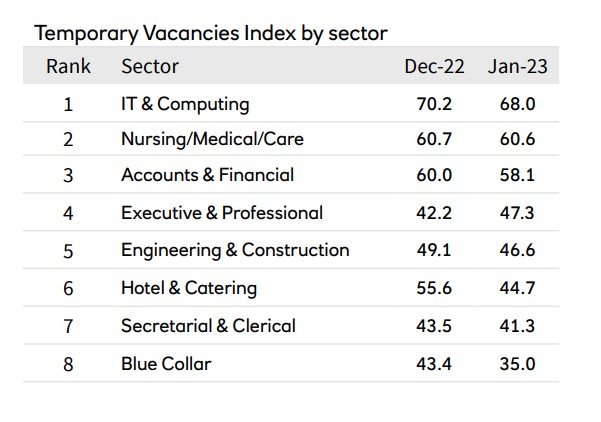

Nursing/Medical/Care also topped the rankings of temporary staff demand in January. Accounting/Financial and Secretarial/Clerical completed the top three in the league table. The only employment category to see reduced demand was Retail.

Sebastian Burnside, Chief Economist at Royal Bank of Scotland, commented: "The bounce back in permanent staff hiring across Scotland was a positive start to 2023, after having declined throughout the last quarter of 2022. Mentions of higher client activity and new projects suggest perhaps a brighter prospect for the year ahead than previously expected. However, while firms have been successful in securing new permanent starters in January, total demand for permanent staff moderated further, with vacancies rising at the softest pace in nearly two years. At the same time, demand for temporary workers fell for the first time in 28 months. The data indicates a shift in the market with a preference for permanent staff. However, lingering concerns over the economic outlook and intense cost pressures at firms indicate that recruitment decisions may be under more pressure in the months ahead.”

Read the complete reports here:

ROYAL BANK OF SCOTLAND REPORT ON JOBS

REC UK REPORTS ON JOBS