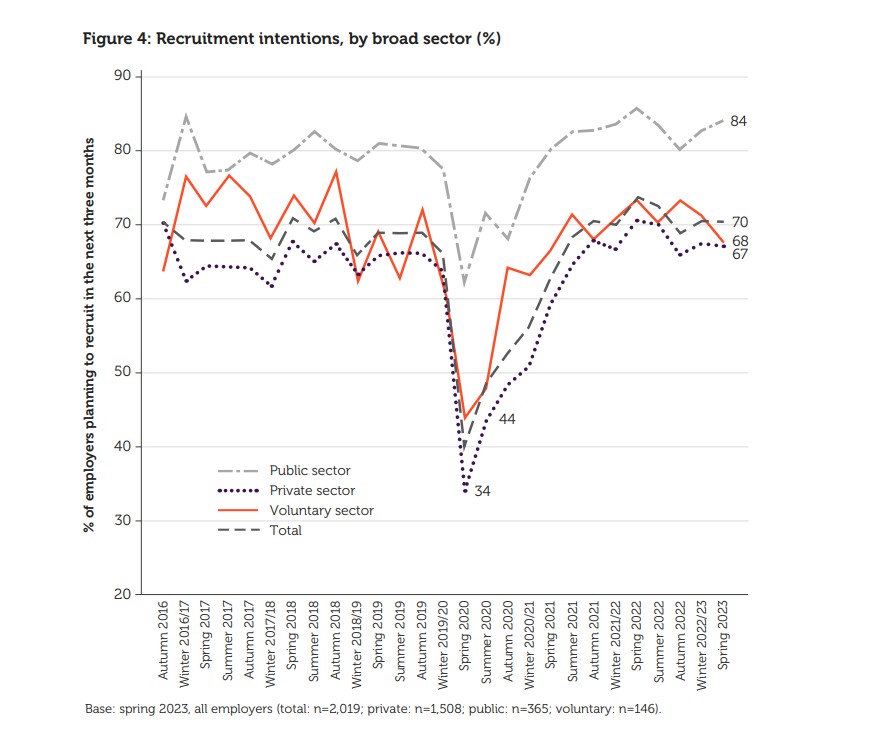

CIPD Labour Market report, 70% employers indicated that they plan to recruit in the next three months

The UK looks to have narrowly avoided a recession, but even if many employers are still recruiting, they have hard-to-fill vacancies. This situation is unlikely to change anytime soon, but employers are looking at ways to improve job quality – which is a critical factor for employees.

The quarterly CIPD Labour Market Outlook provides an early indication of future changes to the labour market around recruitment, redundancy and pay intentions. This quarter’s findings are based on a survey of more than 2,000 employers.

“Our analysis shows that public sector employers are heeding calls for higher wages, as expected pay awards for the coming 12 months have risen in the public sector to their highest level since tracking began in 2012” said James Cockett, CIPD Labour Market Economist.

Key points:

1) Net employment balance remains stable

The net employment balance – which measures the difference between employers expecting to increase staff levels in the next three months and those expecting to decrease staff levels – remained stable at +27. This remains above the pre-pandemic level.

2) Hard-to-fill vacancies persist

Two in five of employers (42%) have hard-to-fill vacancies. These are most prevalent among employers in education (60%) and healthcare (55%). Both industries anticipate significant problems filling their hard-to-fill vacancies in the next six months (42% and 44%).

3) Employers focus on upskilling staff and raising wages

Half of employers with hard-to-fill vacancies have responded by upskilling more existing staff (50%) and raising wages (48%) in the past six months. In future, the level of employers who wish to focus on improving job quality (35%) is higher than the rate who currently do (30%).

4) Public sector pay at new peak

The median expected basic pay increase stands at 5%, unchanged on the quarter. Expected pay awards in the public sector have risen to 3.3%, up from 2% in the previous quarter. This is the highest public sector expected pay increase in the LMO time series.

5) Few employers have a financial wellbeing policy

Only two in five employers (42%) have a financial wellbeing policy, either standalone or as part of a wider employee health and wellbeing strategy (31%). Two in five (39%) employers also do not have a financial wellbeing policy and do not plan to introduce one.

Recruitment intentions are above pre-pandemic levels. Seven out of 10 (70%) employers surveyed indicated that they plan to recruit in the next three months. Recruitment intentions remain highest in the public sector (84%), followed by the voluntary sector (68%) and the private sector (67%) (Figure 4).

READ THE FULL REPORT HERE