Digital Economy Monitor, for techUK the sector is growing

The results of the Digital Economy Monitor survey conducted by techUK for the second quarter of 2023 indicate that the tech sector is experiencing growth. This is a positive sign for the industry and the broader economy. However, there are some concerns that could potentially hinder the sector's growth and overall economic outlook in the UK.

One of the key issues highlighted in the survey is the uncertainty surrounding the UK's economic outlook. Uncertainty can lead to cautious decision-making among businesses, which may result in reduced investment and slower growth. External factors such as global economic conditions, geopolitical events, and government policies can contribute to this uncertainty.

Additionally, concerns over investment are also noted in the survey. The tech industry relies heavily on investments to fund research, development, and expansion initiatives. If there are doubts among investors about the stability or profitability of the tech sector, it may lead to a decline in funding and stifle the growth potential of tech companies.

Infrastructure is another crucial aspect that can impact the tech sector's growth. Adequate and efficient infrastructure is essential for businesses to operate smoothly and deliver their products and services. If there are shortcomings or delays in infrastructure development, it can hinder the tech sector's ability to scale and innovate.

Furthermore, the effects of regulation are also mentioned as a potential challenge. While regulations can be necessary to ensure fair competition and protect consumers, overly restrictive or cumbersome regulations can burden tech companies and inhibit their growth. Striking the right balance between fostering innovation and maintaining a fair and transparent business environment is vital for the industry's success.

“2022 presented significant challenges for the tech sector, as soaring energy prices and a talent shortage resulted in a major drop in confidence. However, 2023 has the potential to end on a brighter note, as techUK members revealed a cautious optimism about their growth and investment plans, with many saying they are on track to meet their company’s ambitions. Still, the tech sector is grappling with uncertainties surrounding the UK’s economic outlook, the impact of regulation, and concerns regarding infrastructure. To unlock the tech sector’s full potential, close collaboration and robust government support are imperative. Together, we can fuel the sector’s growth and supercharge the UK economy, by bringing an additional £200 billion every year.” said Julian David, CEO techUK

There were five key themes shown across the survey results:

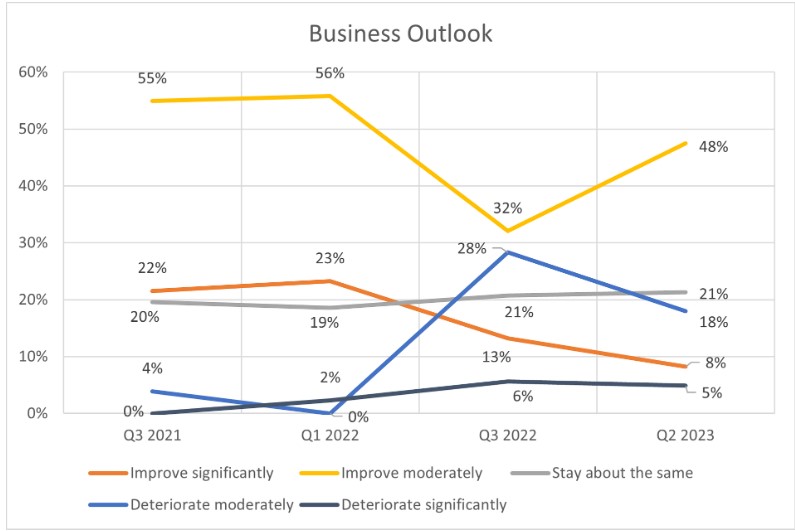

- Business outlook among techUK members has rebounded after a difficult 2022, however techUK members see wider economic challenges on the horizon that could threaten their business plans. 48% of members said they expect it to “improve moderately,” an increase of 16 points from last Monitor.

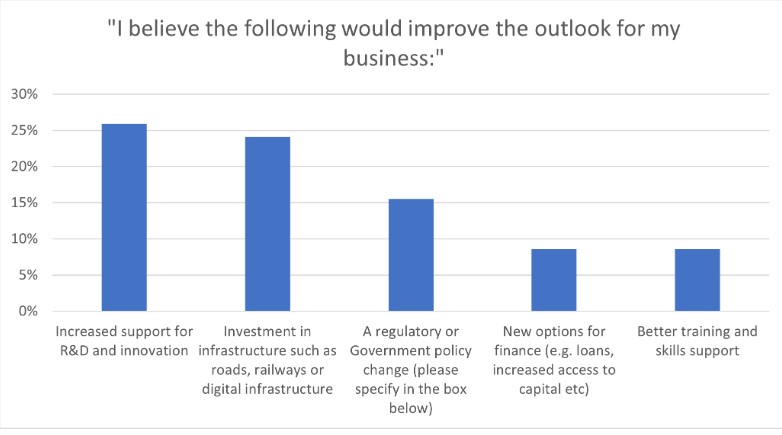

- Industry still requires greater support for R&D and innovation, while access to infrastructure has become a greater concern. When asked what would improve the outlook for their business, members responded that increased support for R&D and innovation (26%), investment in infrastructure (24%), and a regulatory or Government policy change (16%)

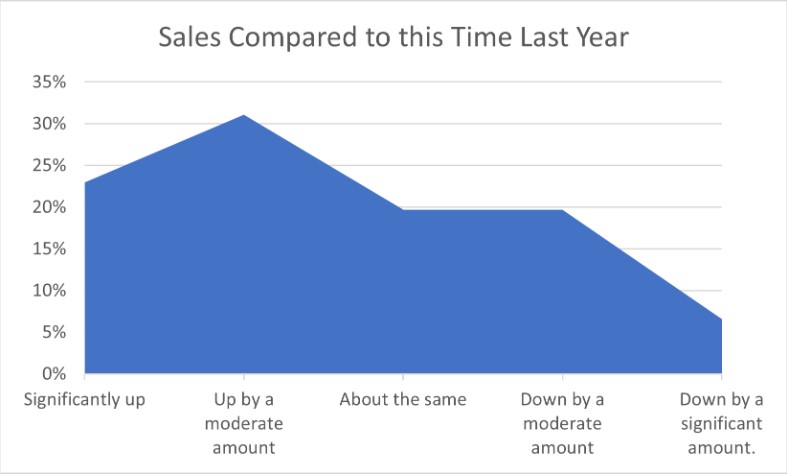

- Sales and investment plans are cautiously looking up, showing that the industry is on the rebound. The outlook for sales is highly variable space in the sector, with the amount of respondents who said their outlook for sales remained the same as last year dropped by 14 points to just 20%. Overall, a majority of respondents (54%) indicated that their sales were up by compared to this time last year.

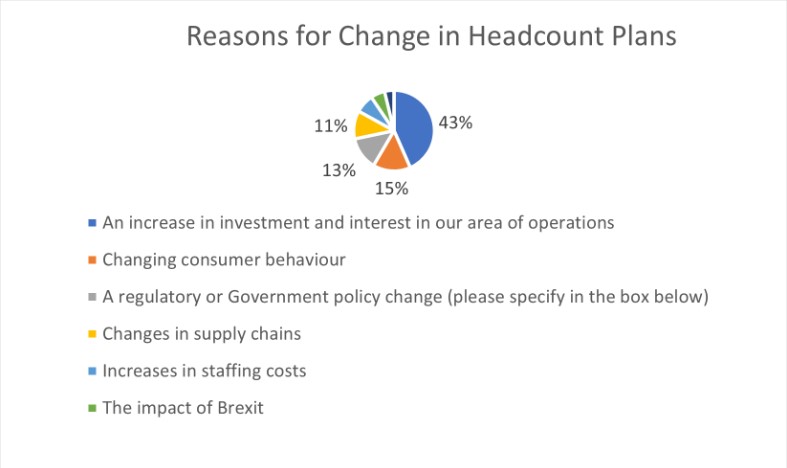

- Though other metrics like investment plans, sales, and outlook had positive signs or trends, industry’s plans for their headcount reveal the burden of economic challenges, which have created a greater focus on efficiency within companies. Plans to reduce headcounts have increased from just 2% of respondents in Q3 2021 to 15% in this iteration of the Monitor. This was also double the number who reported plans to reduce heading count in the last Monitor (7%).

- When asked what longer-term ambitions members had, respondents shared a focus on scaling and growth (30%), expanding within their existing markets or into new markets (24%), and improving efficiency and competitiveness (12%). When asked if they were on track to achieve these ambitions, almost half of respondents indicated that they were on track to achieve most of them (46%), and an additional 43% of respondents shared that they were on track to achieve some, with only 12% of respondents sharing that they were on track to achieve only a few.

SEE FULL REPORT HERE