Report on Jobs, decline in permanent jobs in August

According to the latest Royal Bank of Scotland Report on Jobs survey, hiring conditions across Scotland deteriorated during August, with surveyed recruiters signalling sharp decreases in both permanent placements and temp billings.

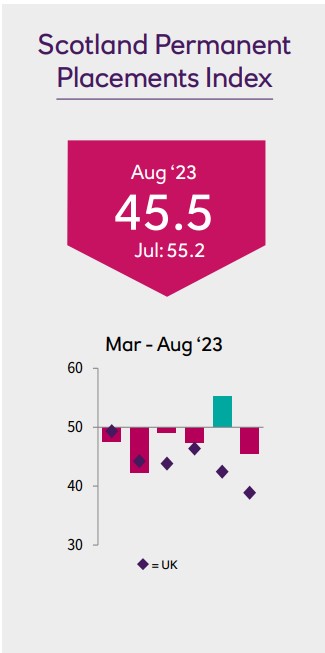

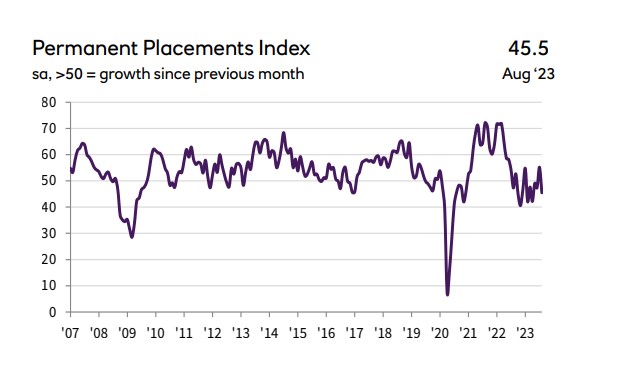

Following a brief rise in July, latest survey data signalled a renewed fall in permanent placements across Scotland during August. Moreover, the rate of contraction was the strongest since April, with recruiters often linking the reduction to weaker economic conditions and a shortage of skilled and desirable candidates.

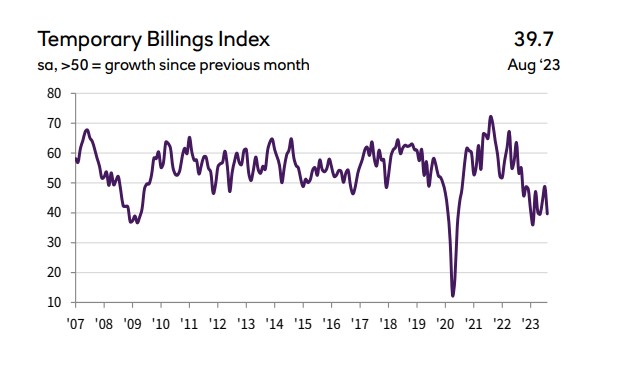

Recruiters across Scotland signalled an eleventh successive monthly reduction in temp billings midway through the third quarter. After having eased in July, the rate of decrease quickened notably to the fastest since May and was marked overall.

Sebastian Burnside, Chief Economist at Royal Bank of Scotland, commented: "The latest survey data highlighted renewed weakness across the Scottish labour market. A smaller pool of desirable and skilled candidates and the muted economic climate meant that hiring activity remained subdued during August, with both permanent placements and temp billings falling sharply. Moreover, fewer work opportunities translated into a reduction in permanent vacancies. Nonetheless, both starting salaries and wages continued to rise at historically strong rates. Competition for scarce and skilled candidates often meant that firms had to pay more to secure the right talent.

"Going forward, with fewer vacancies in the market, and firms already limiting their hiring, the survey suggests a weaker outlook for the Scottish labour market in the remaining months of 2023."

The Report on Jobs, by KPMG and REC, is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for August are:

- Permanent placements and temp billings fall in August: August survey data pointed to a broad-based decline in hiring activity across the UK. Permanent staff appointments fell at a rapid pace that was the quickest seen in over three years, while temp billings also contracted. Though marginal, it was the first time the latter had declined since July 2020. Recruiters frequently mentioned that employers were hesitant to commit to new hires and adopted recruitment freezes due to a weaker economic climate.

- Overall candidate supply continues to rise rapidly: The overall availability of candidates expanded for the sixth straight month in August. Although the rate of improvement slowed from July, it was nevertheless the second-sharpest recorded since December 2020. There were widespread reports that redundancies and a general slowdown in hiring activity had driven the latest rise in labour supply, with both permanent and temporary candidate numbers expanding at rapid rates.

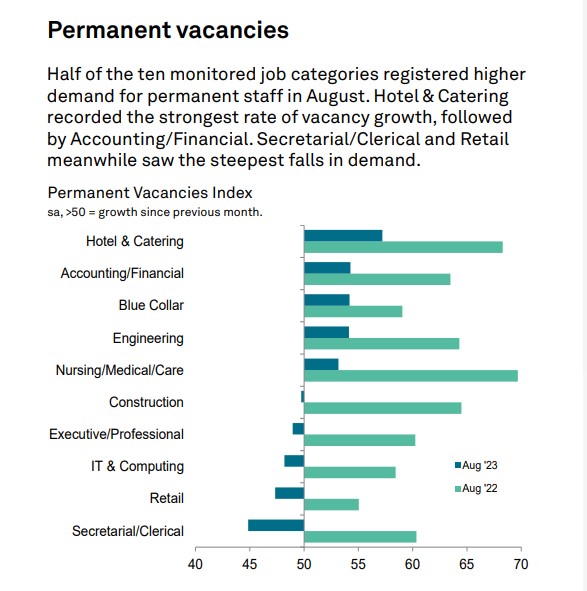

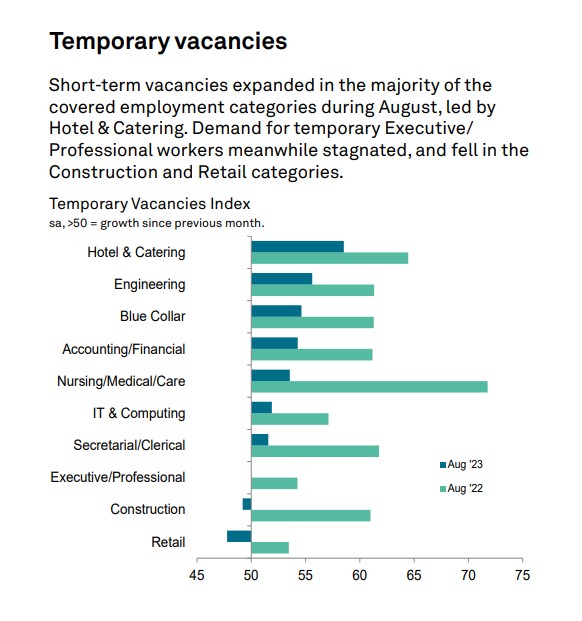

- Total vacancy growth slips to two-and-a-half-year low: Overall vacancy growth softened for the sixth successive month in August. Furthermore, the latest increase in demand for staff was the weakest seen in the current two-and-a-half-year sequence of expansion and only marginal. The slowdown was driven by a softer rise in permanent vacancies, which increased only fractionally, as growth of demand for temporary staff remained strong.

- Pay pressures remain elevated: Starting salaries and temp wages rose sharply in August, with recruiters often commenting that competition for scarce candidates and the higher cost of living had led employers to raise pay. However, the rate of starting salary inflation edged down to the joint weakest since March 2021, and was much slower than that recorded a year ago. While temp pay growth picked up from July, it was the second softest since April 2021.

SEE FULL REPORTS HERE:

KPMG REC, UK REPORT ON JOBS